Section 179D

Energy Reduction = Tax Deduction

Section 179D, aka the Energy Efficient Commercial Buildings Deduction, is a federal tax reward for energy-efficient construction or renovation of commercial buildings. The 179D deduction can yield the building owner a federal income tax deduction of up to $1.80 per square foot for qualifying construction. The deduction is now permanently extended and includes provisions to increase the $1.80 per square foot for inflation in the future.

For building owners, the savings are a function of the time value of money as they accelerate writing off the cost of construction, from the standard 39-year period to an immediate deduction in the year the property is placed in service. For AE firms who do design work for governmental units, the benefit is even better. Because of their tax-exempt status, government entities can allocate the deduction savings to the designer of record. Plus, that firm can take the entire deduction without the 39-year trade off!

Qualifying for 179D can be a significant cash flow boost for your AE firm, but it can be complex. Our Strategic Tax Advisory team is uniquely qualified to help your firm maximize this potentially lucrative deduction.

The Who & What of 179D

The deduction is limited to those firms who are involved in the creation of eligible energy efficient building design specifications including architects, engineers, lighting designers, HVAC designers, and energy services consultants.

Qualifying improvements must fall into one of the following categories: building envelope, HVAC, or lighting system. The installation, repair or maintenance of a qualifying property does not qualify.

Money for Your AE Firm

If your AE firm does governmental work, you can still take advantage of 179D. Since government entities are non-taxable, government agencies are unable to take the deduction for themselves. However, they are able to allocate the deduction to the “designer of record”. This can be a firm such as the project architect, mechanical engineer, electrical engineer, structural engineer or a combination of the contributing design team.

Location, Location, Location = Money in Your Pocket

For firms planning to expand, relocate, or consolidate operations, being strategic about site selection can result in lucrative tax opportunities. We collaborate with you to uncover state and local non-income tax incentives including grants, rebates, enterprise zone benefits, property tax abatement, and sales tax credits/exemptions.

Big Savings to Reinvest

Big Savings to Reinvest

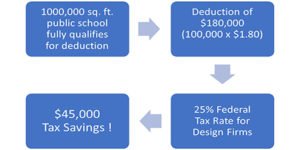

Don’t assume you don’t qualify! Here’s an example of how profitable 179D can be for AE firms. Our strategic tax advisory experts can explore all the options with you to determine how much you qualify for.

The Who & What of 179D

The deduction is limited to those firms who are involved in the creation of eligible energy efficient building design specifications including architects, engineers, lighting designers, HVAC designers, and energy services consultants.

Qualifying improvements must fall into one of the following categories: building envelope, HVAC, or lighting system. The installation, repair or maintenance of a qualifying property does not qualify.

Money for Your AE Firm

If your AE firm does governmental work, you can still take advantage of 179D. Since government entities are non-taxable, government agencies are unable to take the deduction for themselves. However, they are able to allocate the deduction to the “designer of record”. This can be a firm such as the project architect, mechanical engineer, electrical engineer, structural engineer or a combination of the contributing design team.

Location, Location, Location = Money in Your Pocket

For firms planning to expand, relocate, or consolidate operations, being strategic about site selection can result in lucrative tax opportunities. We collaborate with you to uncover state and local non-income tax incentives including grants, rebates, enterprise zone benefits, property tax abatement, and sales tax credits/exemptions.

Big Savings to Reinvest

Big Savings to Reinvest

Don’t assume you don’t qualify! Here’s an example of how profitable 179D can be for AE firms. Our strategic tax advisory experts can explore all the options with you to determine how much you qualify for.