New SN Research Sheds Light on State of AEC Industry Heading Into 2024

How do architecture, engineering, construction (AEC), and environmental firms feel about the business environment as we head into 2024?

Stambaugh Ness recently conducted our second annual Industry Outlook survey and unveiled the results at our Annual AEC Outlook: Looking Toward 2024 webinar.

Biggest Challenges: People, People, People

Perhaps to no one’s surprise, the top issue by far is the Recruitment of New Staff. Seventy-seven percent of survey participants identified it as one of the biggest challenges facing their firm, slightly down from last year’s 85%, but still indicative of a significant problem in the industry. Between the decades-long decline of birth rates, decreased college enrollments, and accelerating retirements as Baby Boomers age out of the workforce, the AEC industry is being hit at both ends. The problem will only worsen as college enrollment enters a new period of decline in the coming years due to the demographic-driven drop in high school graduates.

This year, we expanded the survey options regarding challenges, and one of the new ones we added was The Missing Middle or lack of mid-career professionals. Why did we add it? Working with many clients on strategic planning and ownership transition, we continue to see a “condition critical” situation regarding the lack of enough mid-career AEC employees. In some ways, this is driven by The Great Recession, the young professionals who got downsized and left the industry, or college students switching out of AEC programs because of the extended recession in the built environment, which persisted long after the official end of the economic downturn.

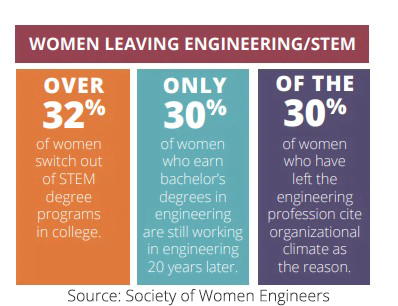

Of course, there are additional factors at play here. Research from the Society for Women Engineers found that 32% of women switch out of STEM degree programs in college, and only 30% who earn a bachelor’s degree in engineering are still working in engineering 20 years later. So, 70% of the women engineers have walked out the door by their mid-career years. Furthermore, the Millennial generation has proved to be very mobile, not just switching employers more often than their predecessors but also switching careers or industries altogether.

Of course, there are additional factors at play here. Research from the Society for Women Engineers found that 32% of women switch out of STEM degree programs in college, and only 30% who earn a bachelor’s degree in engineering are still working in engineering 20 years later. So, 70% of the women engineers have walked out the door by their mid-career years. Furthermore, the Millennial generation has proved to be very mobile, not just switching employers more often than their predecessors but also switching careers or industries altogether.

Compensation & Benefits

Wage Growth was identified by 48% of survey respondents as a major issue in this year’s survey, down from 56% last year but still extremely high. When this is a “biggest challenge” to one of every two firms, it is an industry issue. Unemployment rates are still very low, with the newly released November data showing an unexpected drop in the unemployment rate from 3.9% to 3.7% in the United States. When three-quarters of AEC firms are looking for work, half are concerned about the Missing Middle, and unemployment rates are near record lows; guess what that means? Growth in wages. Firms continue to poach people at artificially high wages, creating an imbalance in compensation structures. It costs more money to get people and more money to keep people. To add insult to injury, 38% of survey respondents now identify Cost of Benefits as one of their biggest challenges, up from 26% last year. AEC firms are becoming more intentional about their benefits programs to recruit and retain staff, but this comes with a cost. Beyond increasing employee benefits, the costs companies pay continue to rise, creating a one-two punch of wage growth and increased benefits, hitting firms directly in the wallet.

Staff Retention

Retention of Existing Staff ranked fifth when it comes to the biggest challenges facing AEC firms, with 37% of firms identifying it as a major issue. This ranking is notably down from 50% in last year’s survey but still impacting more than one-third of firms. Perhaps increased salaries and expanded benefits packages have mitigated some of the concerns around staff retention. Still, the general economic uncertainty and media prognosticators continually warning of the “recession around the corner” also probably contributed to employees sticking around.

Additionally, the AEC economic indicators right now are telling a tale of two different AEC industries. On the one hand are those firms positively impacted by Infrastructure Investment & Jobs Act (IIJA) funding. They are busy, have very healthy backlogs, are looking for more staff, and are okay with backlogs in the coming year. Or two. Or three. Market sectors like highways and streets, transportation facilities and structures, water and wastewater, and utilities continue to have bright outlooks. Manufacturing facilities have been booming the past couple of years, and although that is projected to slow somewhat in the coming year, the outlook is still favorable. On the other hand, commercial and developer-driven sectors have been feeling the pinch of high interest rates, and although the Fed has been raising rates to avert a recession, it has drastically cooled off markets that feed off lower interest rates. Although economists predict an easing of interest rates as 2024 progresses, no one suggests a return to the almost “free” money of historically low-interest rates.

Additional Challenges

In our survey last year, 34% of firms indicated that Project Profitability was a current challenge, and that number inched up to 36% in this year’s data. Although the data doesn’t specifically tell why more than one in three firms is dealing with this, the significant amount of firms challenged by the Missing Middle certainly impacts project profitability, as more senior professionals at higher billing rates continue to rack up considerable project charges. Furthermore, another new response on this year’s service is Staff Development/Training, and 34% of firms selected this option as a current challenge. The lack of training occurring in firms with overworked staff is something that we often hear in working with clients, and the impacts range from burnout to disengagement to ongoing frustration in younger staff regarding the lack of attention paid to their professional development. Only 22% of participants are currently concerned about their ability to Land New Projects, yet this challenge was identified by slightly more than one in five firms. The same number of respondents identified Integrating Artificial Intelligence as an area certain to grow in the coming years as firms increasingly explore the various AI tools available. Currently, the AEC industry is in a discovery phase regarding artificial intelligence.

Breaking Down the Findings

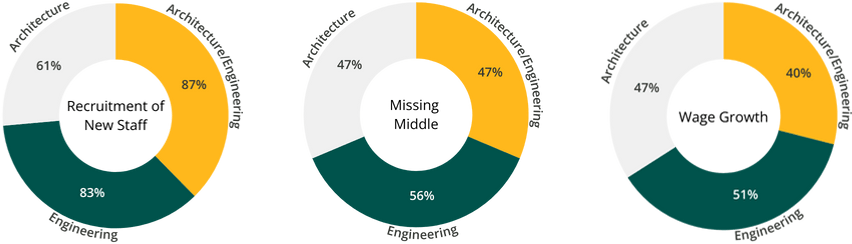

Most survey participants were from architecture, engineering, and combined architecture/engineering (AE) firms. While we did receive survey input from construction, environmental, and other consulting firms, we limited the breakouts under firm type based on sample size. Engineering, architecture, and AE firms are all concerned about Recruitment of New Staff, as it was the top identified challenge across the board. However, this issue is more severe in AE firms (87% of firms) and engineering firms (83%) than it is in architecture firms (61%). Even though we’re aware of architecture firms recently laying off staff, it is often studio-specific, and they continue struggling with finding architectural specialists in other market sectors. The Missing Middle ranked second for engineering firms (56%) and AE firms (47%) and third for architecture firms (47%). For architects, Wage Growth came in second with 47% of firms. The position was flipped with engineering firms, who ranked Wage Growth third at 51%. And for AE firms, Wage Growth is tied with Staff Development/Training at 40% each.

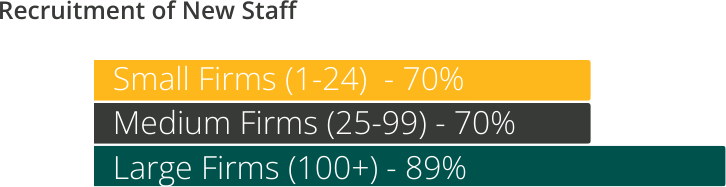

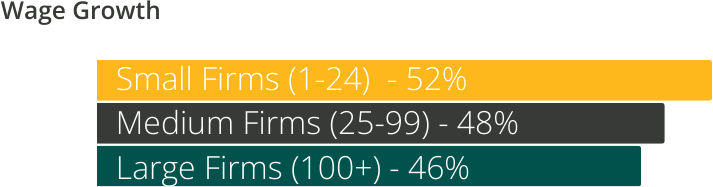

The same challenges bubbled to the top with firms of all sizes, regardless of firm type, with Recruitment of New Staff ranking first for 1-24 employee firms (70%), 25-99 employee firms (70%), and 100+ employee firms (a whopping 89%). Larger firms tend to see higher turnover rates than their smaller counterparts, so this makes sense. Firms in the smaller size category of 1-24 weren’t as concerned about the Missing Middle. Instead, Wage Growth (52%), Project Profitability (45%), and Cost of Benefits (45%) are top of mind right now. For the 25-99 employee firms, The Missing Middle (51%) and Wage Growth (48%) came in very close. The majority of Stambaugh Ness Strategic Planning clients are in the 25-99 and 100+ employee categories. The need for mid-career employees often dominates planning discussions as it impacts their ability to deliver work (not enough experienced professionals), get work (rainmakers retiring), and retain staff (burned-out workers looking for other options). For those 100+ employee firms participating in the survey, the Missing Middle ranked second at 56%, while two challenges tied with 46% of firms each: Retention of Staff and Wage Growth.

If you didn’t have a chance to check out our recent webinar, Annual AEC Outlook: Looking Toward 2024, you can now watch it on-demand. In our next post, we’ll delve into the research findings around year-end revenue expectations and expectations for the economy and revenues in 2024.

Trying to sort through all the disruption to focus on your 2024 annual plan or long-term strategic plan? Stambaugh Ness can help with that, whether guiding strategic or business planning, facilitating trends workshops, or helping you improve your profitability, business development, or overall firm performance. Reach out and let’s discuss your current challenges and opportunities for improvement and growth.