State of AEC Industry Headed Into 2024 (Part 2)

What new challenges and opportunities do the numbers reveal for the architecture, engineering, construction (AEC), and environmental firms as we enter 2024?

Our last post examined the biggest challenges facing AEC firms based on our second annual AEC Industry Outlook Survey. This blog will explore year-end expectations and projections for economic conditions and revenues through the first half of 2024.

Year-End Expectations

When conducting our AEC Industry Outlook survey this year, we added a new question to determine how firms expected to end 2023 in terms of revenues. It has been a good year for AEC and related firms.

When conducting our AEC Industry Outlook survey this year, we added a new question to determine how firms expected to end 2023 in terms of revenues. It has been a good year for AEC and related firms.

Fifteen percent of survey participants anticipate 2023 revenues will be up 20% or greater over 2022. Another 31% of firms – representing the most significant response to this question – anticipate revenue growth of 10-19% over last year. And slightly more than a quarter of firms, 26%, anticipate that revenues will be up 1-9% compared to 2022. When looking at single-digit revenue growth, it is important to consider the impact of inflation. The most recent annualized inflation rate for 2023 is 3.2%, down from 2022’s 6.5% and 2021’s 7%, but still looking to be the third highest rate increase over the past 15 years. So, single-digit growth of just a few percent is merely keeping pace with inflation.

Slightly less than three-quarters of firms participating in the Stambaugh Ness survey anticipate revenue growth this year. Another 8% anticipate no change in year-to-year revenues, while 20% anticipate that revenues will decline in 2023 when compared with 2022.

For those anticipating negative growth, ten percent of AEC firms expect a revenue decline in the 1-9% range, while another 6% expect revenue declines of 10-19%. Finally, the smallest response category for this question was revenues down 20% or more over last year, and fortunately, only 4% of participants indicated that this is their expectation for 2023.

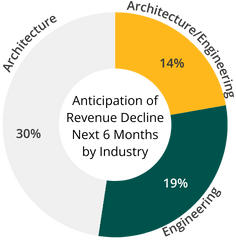

So, where are these declines hitting?

For one, architecture firms. Thirty percent of architecture firms in the survey anticipate declining revenue. The figure is only 19% for engineering firms and 14% for AE firms. Additionally, larger firms with 100+ employees expect revenue to decline the least, with merely 4% of firms in the survey anticipating any decrease. That figure is 29% for firms in the 25-99 employee range and 34% for firms with 1-24 employees, so the smaller the firm, the greater the likelihood of a decline in 2023 revenues over 2022.

For one, architecture firms. Thirty percent of architecture firms in the survey anticipate declining revenue. The figure is only 19% for engineering firms and 14% for AE firms. Additionally, larger firms with 100+ employees expect revenue to decline the least, with merely 4% of firms in the survey anticipating any decrease. That figure is 29% for firms in the 25-99 employee range and 34% for firms with 1-24 employees, so the smaller the firm, the greater the likelihood of a decline in 2023 revenues over 2022.

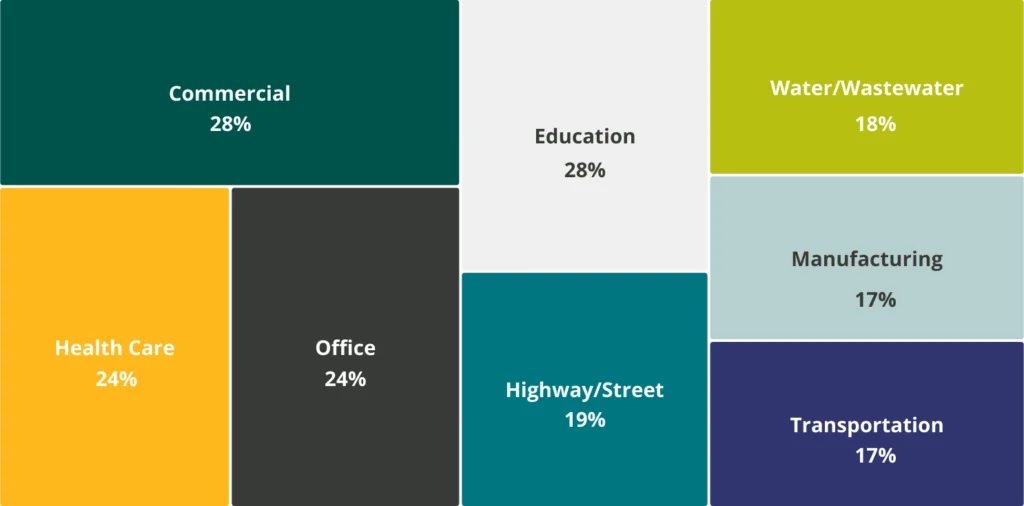

When looking out over select market sectors, a higher percentage of firms operating in the commercial space expect revenue declines, with the fewest firms in the manufacturing and transportation sectors expecting a decrease. Here’s the breakout:

Percent of Participants Operating in the Following Market Sectors Anticipating Revenue Declines in 2023:

When breaking down the responses by geographic region, it’s clear that the larger a firm’s scope of operation (e.g., national, international), the more the firm is insulated from declining revenues. In specific US regions, the smallest percentage of firms anticipating revenue downturns is in the Northeast, with the most significant percentage in the Midwest, closely followed by the West.

Percent of Participants Operating in the Following Geographic Regions Anticipating Revenue Declines in 2023:

Is an Economic Recession on the Horizon?

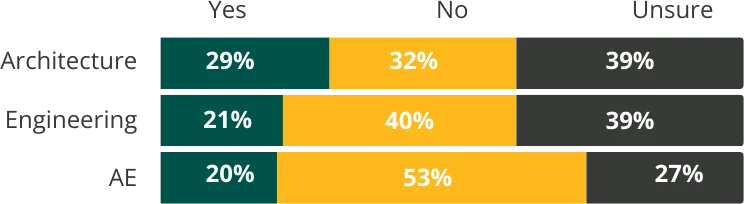

How is 2024 shaping up for AEC firms? We asked survey participants whether they anticipated an economic recession within the next six months.

Twenty-four percent of respondents indicated that they expect a recession in the first half of 2024. Although it represents one in four participants, the figure is down significantly from last year’s survey, when 56% anticipated a recession in the first half of 2023.

Last year, only 14% of our survey participants were not expecting a recession, although 30% were simply unsure. Fast-forward to the current survey, and 41% of respondents do not expect a recession during the first half of 2024. Another 35% are uncertain, so although the percentage of participants indicating that they are unsure has grown, the overall economic outlook is more positive in 2024 than it was in 2023.

How real is this information? The economy continues to exceed expectations, with the third quarter of 2023 GDP growing by 5.2%, unemployment unexpectedly dropping in November to 3.7%, and inflation dropping to less than half of what it was a year ago. There are several positive indicators out there that maybe the US economy is indeed headed toward a soft landing, and we won’t have an extended period of negative GDP growth. Of course, there’s also the election year dynamic and the motivation of elected officials to ensure that economic growth remains positive.

Do you expect an economic recession within the next six months?

When segmenting survey participants, architecture firms tend to be less optimistic than their engineering and AE counterparts, with 29% expecting a recession compared with 32% not anticipating a downturn in the next six months. Conversely, AE firms are the most optimistic, with only 20% predicting a recession and 53% not expecting one. For engineering firms, 21% anticipate a recession in the first half of 2024, while 40% do not.

Firm size plays a role in expectations as well. Smaller firms are far less optimistic. A full 40% of firms in our survey’s 1-24 employee range expect a recession, compared with 33% who don’t. Uncertainty reigns for 25-99-person firms: 44% are unsure, compared with 19% who anticipate a recession and 37% who do not. Almost half of 100+ person firms do not anticipate a recession, but roughly a quarter expect a downturn. Our survey generally finds firms more optimistic about the economy heading into 2024 than they were headed into 2023. Yet, there is still a lot of uncertainty about economic conditions right now.

Projecting 2024 Revenues

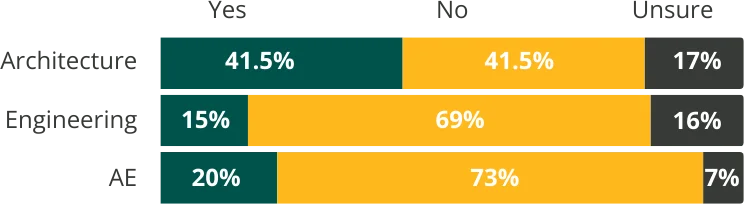

We also queried survey participants on their expectations for revenues over the next six months. While only 20% anticipate that 2023 revenues will finish the year lower than 2022, there’s a whisp of pessimism for revenues in the first half of 2024. Twenty-three percent of participants believe their revenues will decline over the next six months. This is a jump of 5% over last year when only 18% of firms reported expectations for declining revenues.

Do you expect A DOWNTURN IN FIRM REVENUES OVER THE NEXT SIX MONTHS?

However, most survey respondents do not anticipate declining revenues – at least over the next half-year. Headed into 2024, 63% of firms in our survey do not anticipate lower revenues, compared with 66% last year. When breaking out the data by firm type, it is clear that architecture firms have the greatest concern, with slightly more than 41% anticipating declining revenues – compared with the same amount that does not expect revenues to drop. And 17% of architecture firms are unsure right now.

Engineering firms are far more optimistic, with 69% expecting no revenue downturn compared to 15% who do. When looking at the survey data from AE firms, 73% do not expect a revenue decline, compared with 20% who do. Again, these figures reinforce what we see in the commercial and developer-driven markets, which are battered by high interest rates. Firms in horizontal markets benefitting from IIJA funding continue to be bullish in their outlook for the coming year. Still, on the vertical construction side, interest rates continue to play havoc on the built environment.

In our final post of this series, we’ll look into how those firms expecting an economic downturn – or declining revenues – are positioning themselves to prepare. If you didn’t have a chance to check out our recent webinar, Annual AEC Outlook: Looking Toward 2024, you can now watch it on-demand.

Are you trying to sort through all the disruption to focus on your 2024 annual or long-term strategic plan? Stambaugh Ness can help with that, whether guiding strategic or business planning, facilitating trends workshops, or helping you improve your profitability, business development, or overall firm performance. Reach out, and let’s discuss your current challenges and opportunities for improvement and growth.