Government Contract Services

For many architectural and engineering firms, government contracts are a significant revenue stream.

However, contracting with the government isn’t always easy and comes with strict compliance regulations that make it particularly complex. Applying years of collaboration with firms nationally, state departments of transportation, and government agencies, SN’s Government Contract Services team guides you through the layers of red tape associated with government work to help secure contracts, avoid potential roadblocks, enhance profitability, and maintain compliance.

Our deep investment in the architecture and engineering industry translates into a team of professionals who not only know your industry inside and out but have highly specialized expertise and knowledge of government contractor accounting and consulting. Our desire to get results can be seen in everything we do, including the strong relationships we’ve built with organizations that matter to both your industry and your firm. Partnering with organizations like ACEC, AIA, AASHTO, PSMJ, and many state DOTs, we are able to bridge gaps and connect clients to the resources they need.

Whether your firm has a single contract or multiple contracts we have services that you can rely on:

- FAR audits by experts in A/E government contracting.

- Overhead management consulting services.

- Accounting systems review and internal controls gap analysis.

- Internal controls review for direct/indirect expenses and allowable/unallowable expenses.

- Assistance with effective DOT collaboration.

- Balancing tax savings with protecting your overhead rate.

Many firms perform government contract services, but our approach is more than just services, it’s solutions that position you for greater success. Using the detailed information received throughout the audit process your SN team immediately starts thinking proactively and developing management and financial strategies that will benefit your firm.

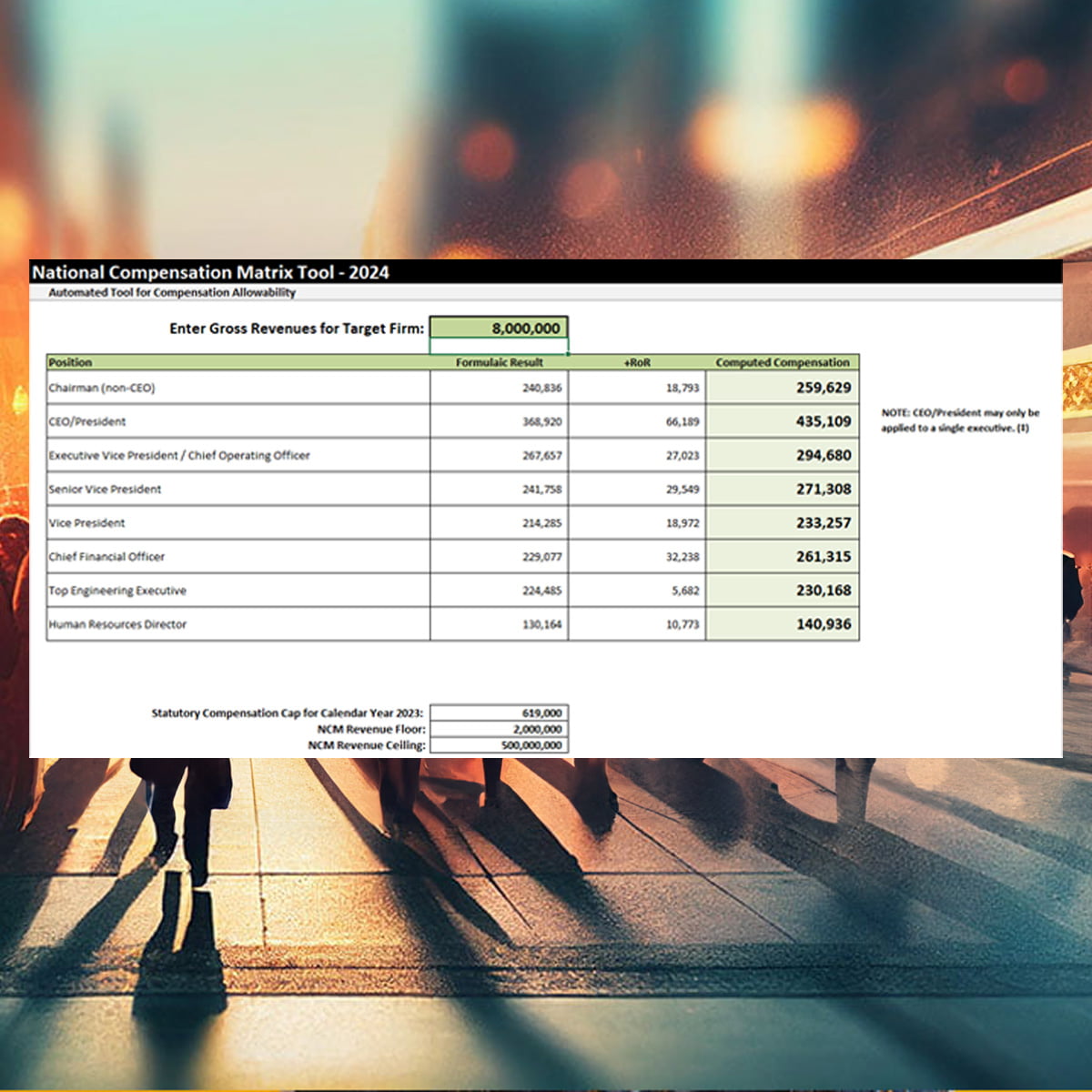

2024 National Compensation Matrix

The American Association of State Highway and Transportation Officials has released its 2024 National Compensation Matrix (NCM).

Optimizing Performance with FAR Allowable Bonus Plans

Join our webinar as we delve into strategies to revamp your bonus/incentive plan, positioning it to not only yield results, but to align with stipulations of the FAR.

FAR Best Practices for Vantagepoint/Vision Users

Get tips from our team for how to setup FAR related items in your Vision/Vantagepoint software.