Maximize Profitability: Overcoming FAR Overhead Rate Decline

In recent discussions with several AE firm CFO’s and executives, one common thread has prevailed, COVID has significantly impacted the way they do business and their overhead rates. In many cases, their forecasted overhead rate is declining, which will result in decreased profitability and cash flow. Because your Federal Acquisition Regulation (FAR) overhead rate drives your firm’s profitability, it is essential to assess and adjust accordingly.

In this blog, I’ll cover important insight I’ve learned while managing government compliance at one of the country’s larger engineering firms and my experiences serving as an AE advisor.

The Strategy Around the Overhead Rate & How the Overhead Rate Drives Profitability

Let’s start by understanding the profit calculation on FAR contracts. As an aside, I’ll generically call it profit, but keep in mind that on Cost-Plus contracts, it’s called “fee,” while Time and Materials contracts and Lump Sum projects appropriately term it as “profit.”

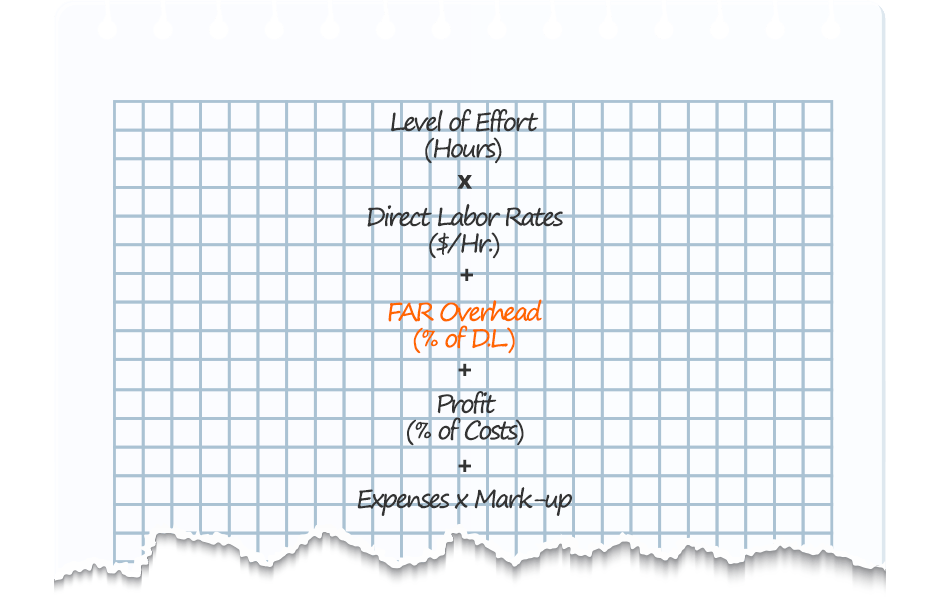

FAR Profit Calculation

Level of Effort (Hours) x Direct Labor Rates ($/Hr.) + FAR Overhead (% of D.L.) + Profit (% of Costs) + Expenses x Mark-up

In many states, the profit calculation is applied to the sum of Direct Labor & Overhead and may be capped if your overhead exceeds certain thresholds. Your overhead rate drives profit, which falls straight to your bottom line.

The calculations are easy, but the real question is, what is the right overhead rate for your firm?

Things to consider:

- What makes you the most competitive?

- What provides the best cash recovery?

- What makes you the most profitable?

- In general, in a period of a slightly declining overhead rate, you have the opportunity to strategically make yourself more competitive, because in theory, the lesser the Overhead Rate, the more:

- work you win & competitive you become

- your direct labor base increases, and your FAR overhead rate decreases

- cash is available to invest in your overhead in appropriate areas

- profitable your projects are

- efficient you can become at forecasting similar jobs, and the cycle of winning work, managing your FAR overhead rate, investing in your business, and becoming more profitable continues.

Based on my experiences, the right overhead rate is the one that makes you the most competitive, maximizes your profitability, and maintains the ability to strategically invest in overhead.

To do that, you need to have a clear understanding of who your customers are, the contracting type they will employ, and the ability to adjust your policies and procedures to maximize your cash flow and profitability within the confines of the FAR.

FAR Overhead Rate Levers

As mentioned previously, I’ve spent years working on the industry front lines. During that time, from a strategic perspective at an AE firm, we continually assessed our business dynamics and managed accordingly. We understood where we planned to end the year and knew specific levers that were adjustable. FAR overhead rate levers can be a critically important element of effectively combatting this trend of decreasing rates.

Identifying adjustable levers can be as simple as conducting a benchmarking analysis of your firm’s overhead spend compared to your peers. The levers are then the items with the most significant variances vs. the benchmark group.

In a few examples, we identified that a firm’s spend related to group insurance was much less than its peers. If the spending is reasonable, it is typically allowable overhead cost. Interestingly, those firms were starting to hear that same feedback via their exit interview process. Plus, this information proved timely as they began to engage in group insurance discussions with their brokers in advance of annual enrollment. They were able to increase their spend on benefits to come in-line with their peers, increase their overhead rate, and address an employee retention issue.

Other areas that ended up being important levers was spend related to:

- Design-Build projects

- IT equipment

- Management Fees

- Rent

- Directors Fees

- Policies on depreciation and amortization

There are many strategies to leverage when your overhead is falling. For instance, using allowable compensation and bonuses to bridge divides and managing controllable items such as contributions to employee benefit plans, and investing in systems and training that improve reporting, business development, and project management effectiveness, to name a few.

Know Your Cost-Plus Contracts Obligations

In a declining overhead rate environment, there are very specific things you need to consider, including your obligations on Cost-Plus contracts. The State DOT’s are often incentivized to true up overhead rates on Cost-Plus contracts during periods of declining overhead rates. As a result, they frequently contract external CPAs to assist them in conducting close-out audits.

Declining overhead rates on Cost-Plus contracts imply an obligation exists with the State DOT’s. Neglecting to account for those obligations can stall M&A activities, overstate profitability and cash flow, and in certain instances, where collected funds are deployed elsewhere, can bankrupt an organization. The obligation and cash flow impact can easily amount to millions of dollars.

At SN, we recommend implementing a system and process to consistently assess and manage this Cost-Plus risk. With many calendar year-end AE firms having three-quarters of 2020 in the books, and the budgeting process for 2021 underway, there is no better time than the present to ensure you are accounting for your 2020 obligations appropriately.

Next Steps

If you need help managing your overhead rate within the confines of the FAR or want to start a conversation about FAR Overhead Services and compliance, reach out to me today. Let’s work together to wrap up 2020 with a plan for maximized profitability in place.

And, if your firm took a PPP loan, I’d like to invite you to watch our complimentary on-demand webinar, FHWA/PPP Update: Get the Facts! SN’s Wayne Owens reviews various questions from the collaborative Questions and Answers – FHWA Treatment of PPP Loan Forgiveness document and shares background and technical information surrounding the key areas.