Operations vs. Financials: What’s Really Costing You

“Those numbers can’t be right!” How many times have you said that to your accountant? You receive your monthly financials and lose your mind. Margins dropped 7% for the month, and you never saw it coming. Why are you always getting surprised?

As an outsourced CFO, I’ve had numerous business owners tell me they can’t find a good accounting leader.

Frequently, the issue has less to do with the financials and more to do with inadequate financial interpretation. Accountants aren’t magicians. Poor execution and business practices will lead to poor financials. Lack of communication with the internal accounting team, along with a lack of monitoring, are the most common reasons owners are “surprised” each month by financial results.

In this blog, we’ll discuss five ways to determine whether it’s operations or accountants that are at the center of your finance issues.

Cash Flow Reports

Most business owners are obsessed with revenue and margin reports but too often overlook the cash flow.

Even the weakest accounting and finance departments tend to reconcile their bank accounts. If your cash flow report indicates that you aren’t generating significant money, the issue is likely your structure or execution, not bad financial reports.

Balance Sheet Metrics

Your standard balance sheet metrics could reveal if your books have an issue. For example, if your average inventory turns are 1x per month, and suddenly you are at 3x, this should trigger you to examine your inventory transactions. It’s very common for shop personnel to enter the wrong quantities when receiving, which should stick out like a sore thumb. Your inventory manager should spot that in a routine review of stock.

Your accountant can help investigate, but a shop error doesn’t make your accountant wrong.

Wide Fluctuation in Balances

It’s always a best practice to look for significant swings in your balance sheet. Balances that are typically positive (e.g., prepaid insurance) showing negative are a signal that perhaps the books are wrong.

Ask your accountant for the reconciliation supporting the account. Review the reconciliation and ensure it’s done correctly; it’s not a statement of activity during the month; it should tell you precisely what is in the account. For example:

If you ask for a reconciliation of employee receivables, you should receive a list of names and amounts owed, not a report showing who took an advance that month.

Map Your Workflows

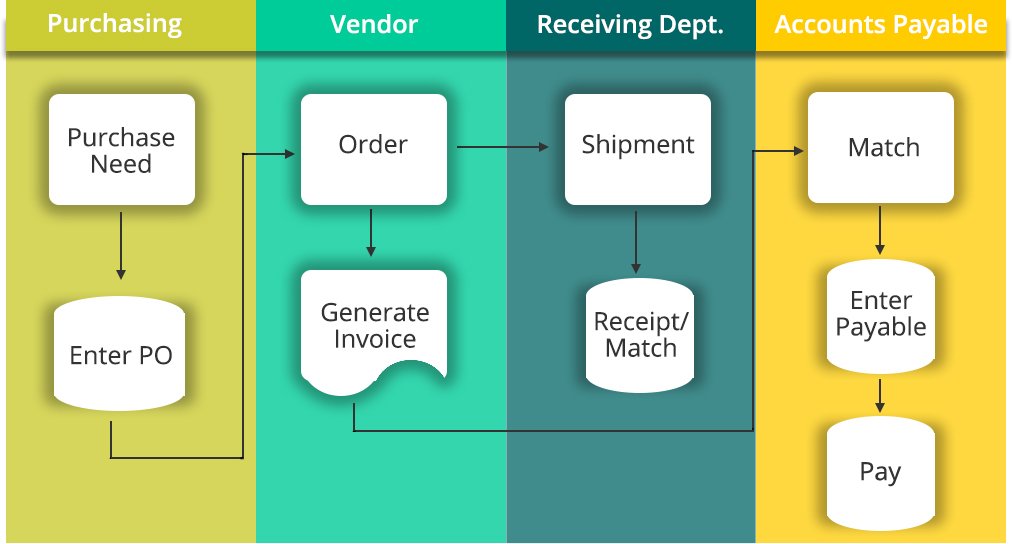

In addition to the tips mentioned above, I recommend adding a process map to your key business workflows. A process map is a planning and management tool that visually describes the flow of work. Process maps show a series of events that produce an end result.

Let’s see how this applies to a common challenge I hear: “our costs are out of control.” Often, owners are tempted to blame accounting. But what if the problem is that your warehouse manager is buying too much? That’s not the responsibility of your Accounts Payable employee. So how could you dig deeper? Let’s look at the flow chart.

This visual demonstrates that it’s the Purchasing Department that approves the spending, not Accounts Payable.

It’s important that you involve the role that is causing the issue. Review your purchase orders by the vendor with your purchasing team and get their thoughts on the increased volume.

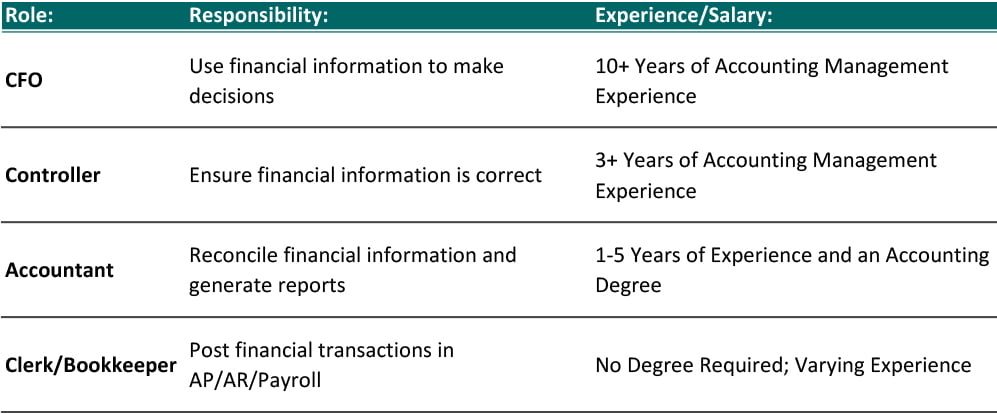

Know the Roles in Your Accounting Department

Accounting departments vary, and often they don’t necessarily grow as the company does. The inability to interpret or predict your financial results could result in asking your financial leader to perform tasks that are not in their skillset.

In simple terms, the roles and typical experience levels in an accounting department are as follows:

Generally, small businesses often have two or fewer of these roles, with an accountant or clerk-level employee serving as a Controller or CFO with the expectation that they serve the elevated position well. If you ask your financial leader to prevent surprises and improve profits, you’re asking one person to perform two different functions. Outsourcing is an efficient option to supplement your team if your business lacks a CFO or controller experience. It allows your company to gain high-level financial experts without paying for one full-time.

There are no hard and fast rules to identify if you need additional accounting support, but these recommendations are a good starting point. For a more in-depth look at this topic, watch our on-demand webinars designed just for manufacturers: Are Your Financials Right and Wrong? and Jump Start Growth with Process Mapping. Both webinars are 30-minutes and complimentary.