Research & Development Tax Credit

Investing in innovation benefits your bottom line.

When you leverage the Research & Development tax credit, you uncover an opportunity to reinvest thousands of dollars into your architecture, engineering, or construction firm. Yet, it’s one of the most underutilized credits available. Don’t fall for the myth that the R&D credit is only for large firms in specific industries. Discover how AEC firms just like yours are significantly enhancing their cash flow through this powerful tax-saving strategy.

What Is the R&D Tax Credit?

The R&D tax credit is a dollar-for-dollar Federal credit designed to stimulate the research and development activity of companies by reducing their after-tax cost. Firms that qualify for the credit can deduct a percentage of qualified research expenditures above a base amount from their corporate income taxes. The credit can be taken during the year earned or carried back for one year or forward for 20 years. In addition to Federal, many states offer similar credits.

Not Just for Scientists & Hi-Tech Labs

The R&D Tax Credit is not industry-exclusive. Any company that develops, designs, or improves products, processes, formulas, techniques, inventions, or software may be eligible. It’s important to note that the credit is based on the effort, not whether the outcome was successful.

Reaping the Benefits

Eligibility depends largely on whether activities meet the criteria established by a four-part test (Qualified purpose, Elimination of Uncertainty, Process of experimentation, and technological in nature). Claiming the R&D Tax Credit can be complex, but with SN’s R&D Tax Credit Study, we take the burden off of your shoulders. SN’s study fully analyses, qualifies, and documents your R&D efforts in a detailed report providing all the required information to support the credit calculation.

What Is the R&D Tax Credit?

The R&D tax credit is a dollar-for-dollar Federal credit designed to stimulate the research and development activity of companies by reducing their after-tax cost. Firms that qualify for the credit can deduct a percentage of qualified research expenditures above a base amount from their corporate income taxes. The credit can be taken during the year earned or carried back for one year or forward for 20 years. In addition to Federal, many states offer similar credits.

Not Just for Scientists & Hi-Tech Labs

The R&D Tax Credit is not industry-exclusive. Any company that develops, designs, or improves products, processes, formulas, techniques, inventions, or software may be eligible. It’s important to note that the credit is based on the effort, not whether the outcome was successful.

Reaping the Benefits

Eligibility depends largely on whether activities meet the criteria established by a four-part test (Qualified purpose, Elimination of Uncertainty, Process of experimentation, and technological in nature). Claiming the R&D Tax Credit can be complex, but with SN’s R&D Tax Credit Study, we take the burden off of your shoulders. SN’s study fully analyses, qualifies, and documents your R&D efforts in a detailed report providing all the required information to support the credit calculation.

Estimate Your R&D Tax Credit

How much money could you potentially put back in your pocket? Schedule your complimentary R&D consultation with one of our research and development experts to find out!

Meet the “Go-To” Tax Credit for AE Firms

by Tom Moul

The R&D Tax Credit for Beginners

Learn about this powerful, but highly under-utilized tax credit.

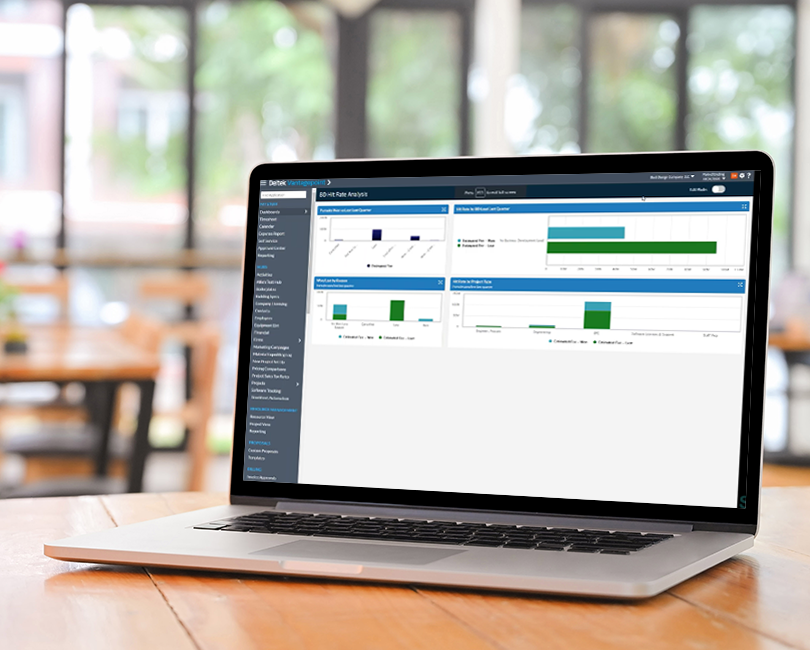

R&D Best Practices for Vantagepoint/Vision Users

Learn how to optimize R&D Credit results with better data capture.