QoE in AEC M&A: Why Quality of Earnings Can Make or Break Your Deal

In the consolidating Architecture, Engineering, and Construction (AEC) industry, one factor often determines whether a merger and acquisition (M&A) succeeds or stalls: the Quality of Earnings (QoE). As firms navigate talent shortages, new technology, and shifting economic conditions, a QoE report provides essential transparency and helps optimize value.

This article explores what a QoE in AEC M&A entails, its critical role in the process, the strategic advantages for sellers who conduct one pre-sale, and key considerations for both buyers and sellers.

Understanding QoE and Its Role in AEC M&A

At its core, a Quality of Earnings report is a detailed financial analysis that evaluates the accuracy, sustainability, and reliability of a company’s reported earnings. Unlike a standard audit, which verifies compliance with accounting standards, a QoE digs deeper into the details. It adjusts for non-recurring items, unusual expenses, and aggressive accounting practices to reveal a company’s true economic earnings. Typically, this analysis focuses on normalized EBITDA (earnings before interest, taxes, depreciation, and amortization) to provide a clearer picture of ongoing cash flow.

In the AEC sector, where revenues are often project-based and subject to long cycles, QoE is indispensable. AEC firms deal with complex variables like contract backlogs, work-in-process (WIP) schedules, and cut-off errors in project billing, all of which can distort earnings if not properly adjusted.

During due diligence, buyers use QoE to validate these elements and identify potential red flags like customer concentration or unsustainable margins. This process not only mitigates post-acquisition surprises but also informs deal structuring, such as earn-outs tied to future performance.

Ultimately, a QoE bridges the information gap between buyers and sellers. For AEC firms with irregular revenue streams from large projects, a robust QoE report can justify higher multiples by demonstrating recurring earnings strength. Without it, deals can falter, buyers might walk away or demand steep discounts, and sellers risk leaving money on the table.

The Strategic Value of a Pre-Market QoE for Sellers

For sellers in the AEC space, commissioning a sell-side QoE before going to market offers a distinct strategic advantage. This proactive step allows owners to uncover and address financial inconsistencies early, turning potential weaknesses into strengths. For example, identifying non-recurring revenues or accounting errors enables corrections that could boost adjusted EBITDA and directly impact valuation.

Strategically, a pre-market QoE builds credibility with buyers, signaling transparency and preparedness. In AEC M&A, where due diligence scrutinizes backlog replenishment and contract audits, this can accelerate timelines and reduce the need for renegotiations. It gives sellers leverage by allowing them to articulate their earnings story upfront, such as normalizing for one-off expenses like legal fees or non-operational costs.

Key QoE Considerations: Buyer and Seller Perspectives

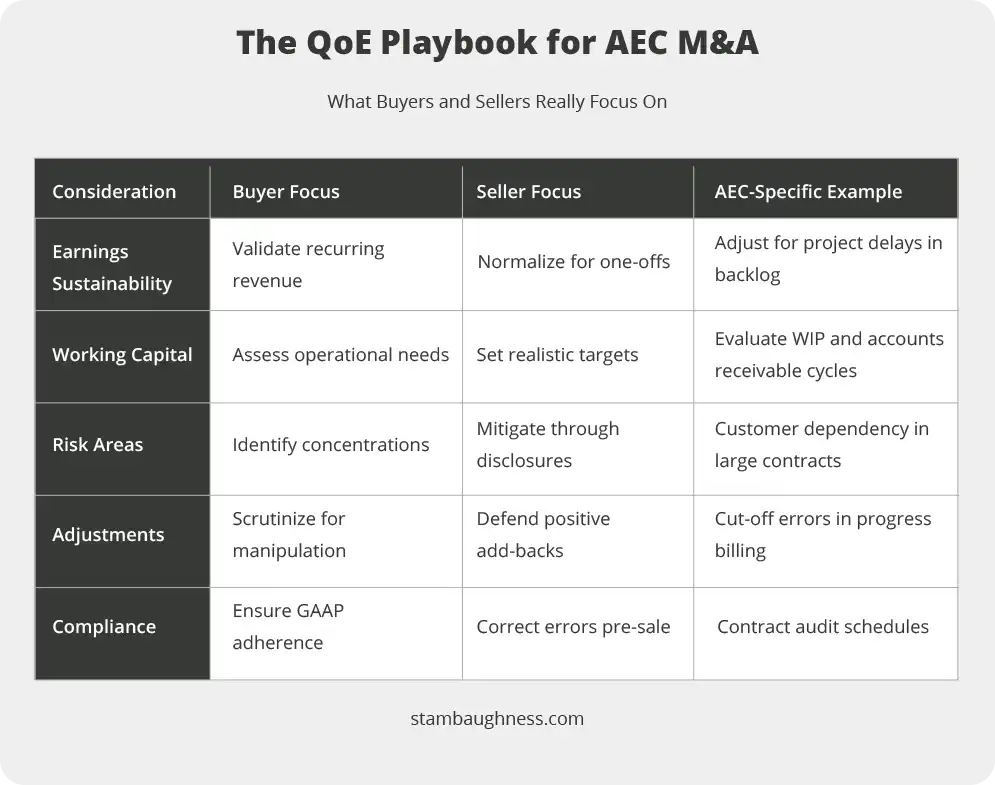

While both sides aim for alignment on value, their focus during the QoE process differs.

From the Buyer’s Lens: Risk Mitigation Priority

Buyers prioritize comprehensive risk mitigation. Key areas of focus include assessing earnings sustainability – is revenue from repeatable clients or one-off mega-projects? In AEC, this involves scrutinizing backlog quality, WIP accuracy, and potential cut-off errors. Buyers also evaluate working capital needs, as an undercapitalized firm might require a cash infusion post-deal. A QoE might lead to price holdbacks or earn-outs to protect against these risks.

From the Seller’s Viewpoint: Maximizing and Defending Value

Sellers focus on maximizing value and defending their position. They should be prepared to highlight positive adjustments, such as reinstating owner perks or accounting for non-recurring losses, to support a higher valuation. For AEC firms, this means justifying project timing variances or a strong backlog as sustainable earnings drivers. Engaging independent advisors early helps articulate these points and reduces potential pushback from buyers.

The Bottom Line: QoE as a Competitive Advantage

In an AEC market where every deal carries high stakes and valuations continue reaching new heights, QoE isn’t just another due diligence requirement; it’s a competitive advantage that can determine transaction success. Whether you’re preparing to sell your firm or evaluating acquisition opportunities, embracing QoE early in your process can transform potential pitfalls into opportunities for stronger, more successful outcomes.

Smart sellers use QoE to command premium valuations, while sophisticated buyers leverage it to structure deals that protect their investments and ensure post-closing success. The firms that understand and master this process will continue to lead the consolidation wave reshaping our industry.

Ready to master QoE in your next deal?

Join our upcoming webinar, Quality of Earnings in AEC: What Buyers & Sellers Need to Know, for expert insights, case studies, and practical strategies you can implement immediately.