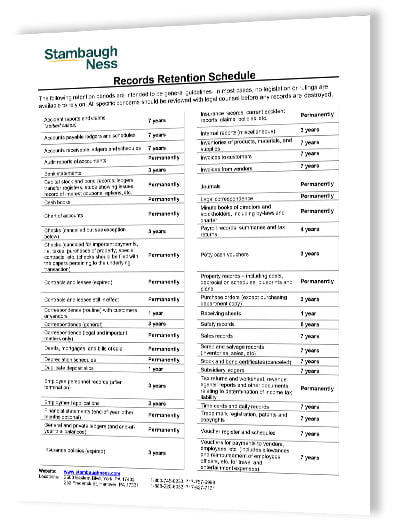

Record Retention Schedule

Ever thought to yourself… how long should I keep these documents?

Record retention time varies on the action, expense or event in which the document is recorded. A general rule is to keep records for a minimum of three years for individuals and four years for businesses, however, there are exceptions to that rule.

Record retention time varies on the action, expense or event in which the document is recorded. A general rule is to keep records for a minimum of three years for individuals and four years for businesses, however, there are exceptions to that rule.

The IRS does not require you to store your records in any particular way, but there are some guidelines to follow. For your convenience, Stambaugh Ness has created a “cheat sheet” of general guideline retention periods for all types of documents varying from time cards to legal correspondence and insurance records.