FAR Overhead Audits vs. Compilations: What DOT Contractors Need to Know

For architecture, engineering, and other professional services firms working with state Departments of Transportation (DOTs), preparing a compliant overhead rate is a critical step in securing and maintaining contracts. Missed deadlines, unexpected costs, and rejected rates can derail a project before it even begins.

Whether your firm is new to government contracting or transitioning out of a Safe Harbor program, understanding the difference between a FAR overhead compilation and a FAR overhead audit, and preparing accordingly, can save time, reduce costs, and ensure timely approvals.

What Is a FAR Overhead Compilation?

A FAR overhead compilation is a financial statement prepared by a firm’s accountant that calculates the indirect cost rate (also known as the overhead rate) in accordance with the Federal Acquisition Regulation (FAR) Part 31. This rate is used to determine allowable overhead costs that can be billed to government contracts.

Unlike an audit, a compilation does not involve testing or verification by an independent CPA. Instead, it is a presentation of financial data provided by management, formatted to meet the requirements of FAR and the AASHTO Uniform Audit & Accounting Guide.

Some state DOTs, particularly for smaller or newer firms, may accept a compilation in lieu of an audit, especially for firms exiting Safe Harbor programs or those with limited government contract activity.

What Is a FAR Overhead Audit?

A FAR overhead audit is a formal examination of a firm’s indirect cost rate scheduled by an independent CPA. The audit must be conducted in accordance with Generally Accepted Government Auditing Standards (GAGAS), also known as the Yellow Book, and must evaluate compliance with:

- FAR Part 31 cost principles

- Cost Accountant Standards (CAS)

- AASHTO Audit Guide requirements

- State-specific regulations, where applicable

The audit includes testing of labor distribution, unallowable costs, internal controls, and the accuracy of the indirect cost rate schedule. It results in an audit opinion and is often required for firms with larger contracts or those seeking a cognizant approval of their rate.

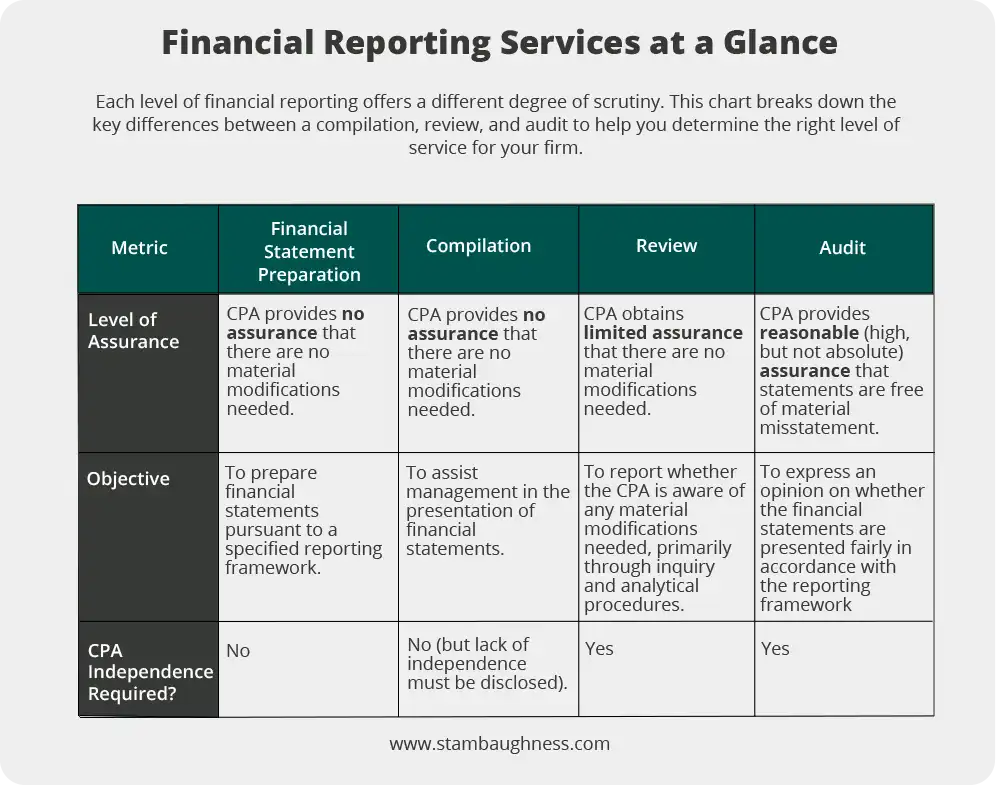

The chart below demonstrates the key differences between various levels of financial reporting.

When Is a Compilation Acceptable?

While each state DOT has its own policies, a compilation may be accepted when:

- The firm is new to government contracting.

- The firm is exiting a Safe Harbor program.

- The firm’s contract volume is below a certain threshold.

- The DOT has not designated the firm as high-risk.

However, even when a compilation is accepted, the firm must still comply with FAR Part 31 and be prepared for a future audit. That’s where audit readiness becomes essential.

Why Audit Readiness Matters

Whether your firm is preparing a compilation or an audit, the accuracy and completeness of your indirect cost rate schedule are critical. Auditors are prohibited from preparing the same financial statements they audit, due to independence rules under GAGAS. This means that if your CPA auditor has to assist in preparing your indirect cost rate schedule, it can:

- Delay the audit

- Increase audit costs

- Disrupt the auditor’s schedule

- Cause missed DOT submission deadlines

To avoid these issues, many firms engage in a FAR Overhead Audit Readiness project before the audit begins.

Ensure Compliance with Hands-On Support

Let our Government Contracting team guide you. We’ll work alongside you to prepare audit-proof schedules and documentation, giving you peace of mind while you focus on your business.

What’s Included in a FAR Overhead Audit Readiness Project?

A FAR overhead audit readiness project helps your firm organize and prepare all necessary documentation and schedules before the audit. Key components include:

AASHTO Internal Control Questionnaire (ICQ) Preparation

The ICQ is a required document that outlines your firm’s accounting policies, timekeeping procedures, and internal controls. It is reviewed by auditors and DOTs to assess risk and compliance.

Indirect Cost Rate Schedule Preparation

Your firm’s version of the Statement of Direct Labor, Fringe Benefits, and General Overhead must be prepared in accordance with the AASHTO Guide. This includes segregation of direct and indirect costs, identification of unallowable costs (FAR 31.205), and proper allocation of expenses.

Supporting Documentation

Auditors will require access to payroll registers, timesheets, invoices, receipts, the general ledger, and executive compensation analysis.

Review of High-Risk Accounts

Certain accounts, such as travel, meals, advertising, and professional fees, are frequently scrutinized. A readiness review ensures these are properly classified and supported.

Reconciliation to Financial Statements

The overhead schedule must reconcile to your firm’s financial statements and tax filings. Discrepancies can trigger audit findings or rate disallowances.

Let’s Get Your Firm Audit-Ready

Now that you understand the critical differences between a FAR overhead compilation and audit, the next step is to put that knowledge into action.

I invite you to join me for a live, 90-minute webinar where I’ll personally walk you through a step-by-step guide to building a compliant and defensible indirect cost rate. My goal is to help you move from theory to practice. I’ll show you how to assemble the right documentation, complete the AASHTO ICQ, and avoid the common pitfalls I’ve seen delay approvals and increase costs for firms like yours.

Handle Your Next Audit with confidence

Join our live, 90-minute webinar with Government Contracting expert Robert Jones. You’ll get a step-by-step playbook to build a compliant indirect cost rate and prepare for a smooth audit.